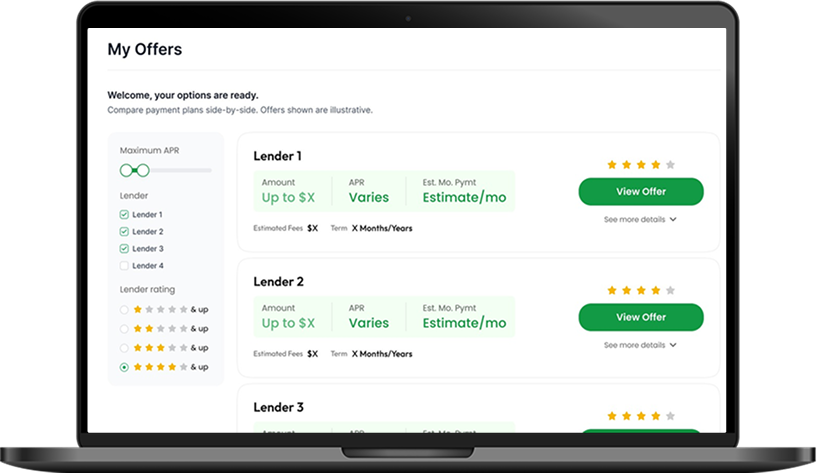

Compare payment-plan options

from multiple providers in one place,

so you can move forward with representation sooner.

Receive an instant decision after you apply, then review your options.

Access a wide range of providers, review multiple payment-plan options with one application.

Choose a payment option that fits your budget and timeline, designed for legal fees and case-related costs.

No fees from CaseFunders. Payments are fixed, and any interest is shown up front before you choose an option.

Select the Option below to get started

Answer a few questions to check your options.

Compare payment plan options.

Choose an option and move onward with your attorney sooner.

Designed to work seamlessly with attorneys, fitting into the consultation and intake process to keep everything moving without delays.

All data is encrypted to help keep your information private and protected throughout the process.

A streamlined, paperless workflow that keeps everything simple and organized without printing or scanning.

Get help anytime through

live chat when you have questions.